Business Insurance in and around Denver

One of Denver’s top choices for small business insurance.

Cover all the bases for your small business

Insure The Business You've Built.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like a surety or fidelity bond, worker's compensation for your employees and errors and omissions liability, you can feel confident that your small business is properly protected.

One of Denver’s top choices for small business insurance.

Cover all the bases for your small business

Insurance Designed For Small Business

When you've put so much personal interest in a small business like yours, whether it's a book store, a juice store, or a floral shop, having the right protection for you is important. As a business owner, as well, State Farm agent Jack Downing understands and is happy to offer personalized insurance options to fit the needs of you and your business.

Get right down to business by getting in touch with agent Jack Downing's team to talk through your options.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

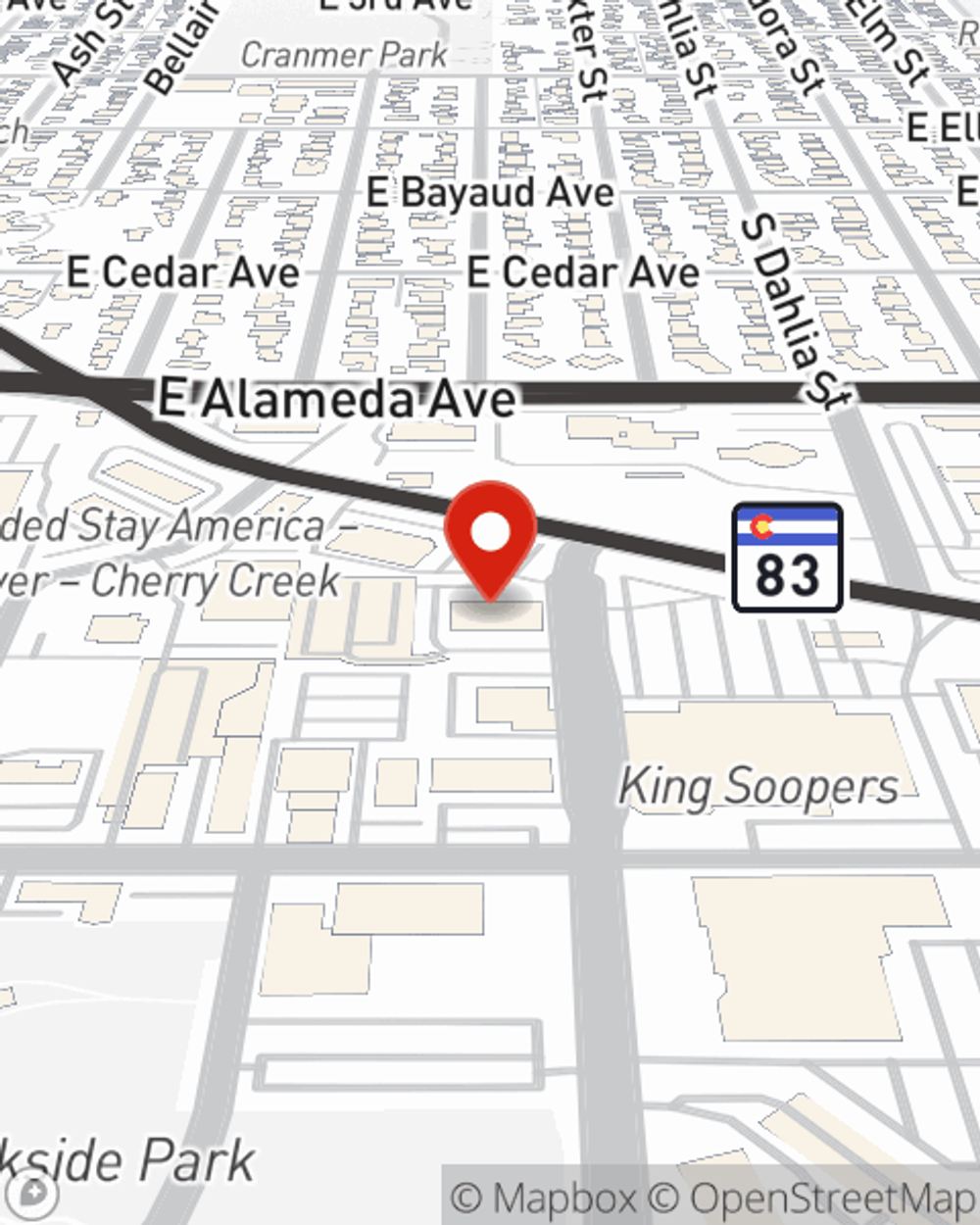

Jack Downing

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.